Lisa Su apologizes if she seems tired. It’s the day after the U.S. presidential election, and like much of the nation she was awake until the early hours, transfixed as the results came in, only tearing herself away once it became clear that Donald Trump had won. “I wanted to know,” Su explains as she takes her place at the head of a conference table in the Santa Clara, Calif., headquarters of Advanced Micro Devices (AMD). “It’s relevant information.”

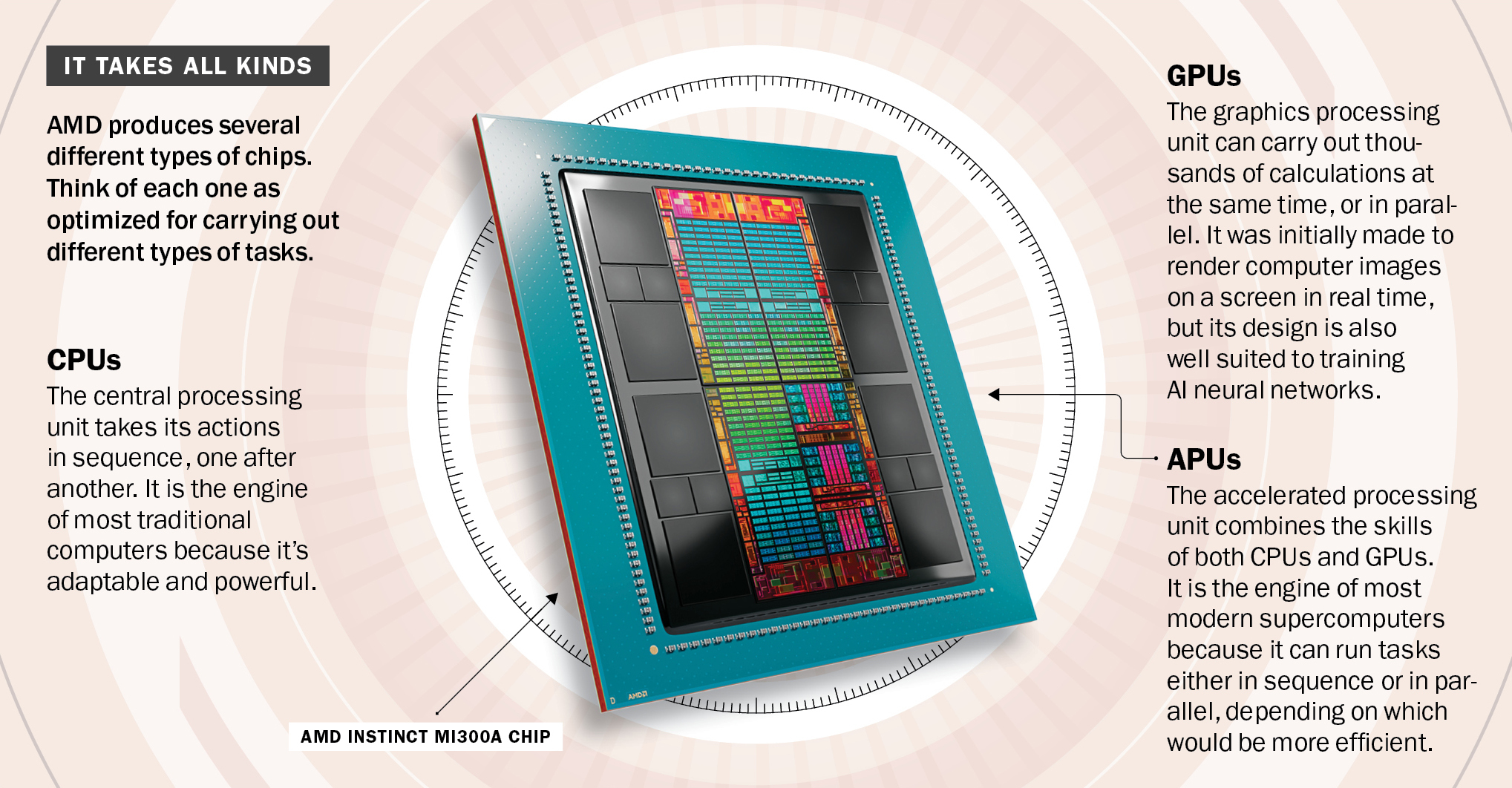

The identity of the next President is pertinent news to most of America’s CEOs, but few more so than the leader of a top semiconductor company. Semiconductors, or chips, are the engines of our computers, phones, cars, internet services, and—increasingly—our artificial intelligence (AI) programs. The relentless rise of the chip over the past seven decades has grown economies, transformed lives, and helped cement the U.S., where most chips get their start, as the globe’s postwar hegemon. AMD is one of the world’s leading designers of the CPU chips that power both personal computers and data centers, the vast warehouses of servers that make possible the likes of Google, Meta, Amazon, and Microsoft. It’s also a top designer of graphics processing units, or GPUs, the specialized chips used to create and run AI programs like ChatGPT. When you send an email, stream a movie, buy something online, or chat with an AI assistant, chances are an AMD chip is providing some of the computing power needed to make that happen. In November, a supercomputer that runs on AMD chips displaced another AMD-based machine to become the world’s most powerful.

Which is thanks in large part to Su’s leadership. When she became CEO a decade ago, AMD stock was languishing around $3, its share of the data-center chip market had fallen so far that executives rounded it down to zero, and the question on everybody’s lips was how long the company had left. An engineer by training, Su spearheaded a bottom-up redesign of AMD’s products, repaired relationships with customers, and rode the AI boom to new heights. In 2022 the company’s overall value surpassed its historical rival Intel’s for the first time. AMD stock now trades at around $140, a nearly 50-fold increase since Su took over. This fall, Harvard Business School began teaching Su’s stewardship of AMD as a case study. “It really is one of the great turnaround stories of modern American business history,” says Chris Miller, a historian of the semiconductor industry and the author of Chip War.

Purchase prints of this issue’s covers here in the TIME Cover Store

For all its progress, AMD remains the semiconductor industry’s distant No. 2. As Su’s team was speeding past Intel, both companies were lapped by Nvidia, run by Su’s cousin Jensen Huang, which in two years has risen from industry also-ran to become the most valuable company in the world. Nvidia got a jump on its rivals by realizing that its chips, initially made for rendering graphics, happened to be perfectly suited for training neural networks, the programs that underpin modern AI. Of the $32 billion worth of AI data-center GPUs sold in the third quarter of 2024, Nvidia’s accounted for some 95%. In November, AMD announced that it would lay off 4% of its global workforce in what it framed as a restructuring to focus on the opportunities from AI. Meanwhile, big tech customers, like Microsoft, Meta, and Amazon, are now designing their own specialized chips for AI workloads, which could reduce their reliance on AMD products. And AMD’s continued growth relies on a host of factors outside its control: continued progress in AI; the security of Taiwan, where the vast majority of its top chips are manufactured; and the actions of a notoriously unpredictable U.S. President. Trump’s return to the White House will bring new turbulence to an industry that has barely caught its breath from a half-decade of geopolitical showdowns, shortages, and an AI-fueled market boom.

A lot rides on Su’s ability to steer the company through these obstacles. People who know her describe Su as a shrewd strategist who invests in talented people and jettisons those who aren’t pulling their weight. “I don’t believe leaders are born. I believe leaders are trained,” she tells TIME, ahead of a strategy meeting where she delivers blunt feedback to her executives and urges them to move faster and delegate more. Su, 55, holds meetings on weekends and is known among her executives for wanting to talk on morning calls about the finer points of long documents that were circulated after midnight. When prototype chips get delivered from the factory, she often personally goes down to the lab to help scrutinize them. It’s a hard-charging style that isn’t for everyone and makes it difficult for people who don’t meet their commitments to survive at the company, according to Patrick Moorhead, a tech-industry analyst and a former AMD executive who left before she joined.

The potential for artificial intelligence to transform science, health care, and the world of work hinges on access to a diverse supply of chips. In the brewing cold war between the U.S. and China, semiconductors are among the most vital battlegrounds. And America’s economic success—as measured by its stock market, at least—depends now more than ever on the continued growth of companies that design, produce, and utilize chips. Allies say Su is up to the task. “We couldn’t have a person better qualified for this job,” says Jerry Sanders, the company’s 88-year-old founder and its first CEO. Does she have what it takes to beat Nvidia one day? “Not a question in my mind,” he says.

In October 2014, Forrest Norrod was sitting in his car at a McDonald’s drive-through when he got a phone call from Su. Norrod had just quit his job as an executive at Dell, intending to take some time off. Su wanted to pitch him on joining AMD, where she had just been appointed CEO. While Norrod waited for his Quarter Pounder with cheese, he listened to her vision for the struggling company. By the next day, he was at AMD’s Austin headquarters, weighing the opportunity to lead its server business. Norrod had seen how the pace of innovation in the cloud-chip industry had dropped off once AMD had allowed Intel to dominate the market, and believed that customers were paying the price. He got a sense that Su was a leader with a rare combination of traits: a technical background, business acumen, and people skills. He accepted the job.

Su was born in Taiwan and moved to the U.S. at age 3, when the family immigrated so her father could attend graduate school. She grew up in New York City and discovered a love of STEM subjects at an early age, growing fascinated by the ability to write rudimentary programs on her Commodore 64 computer. She fondly recalls creating, at the science-focused high school she attended in the Bronx, a project in which she simulated a hurricane inside a box, complete with boiling water and windows through which to watch the maelstrom. She chose to major in electrical engineering at MIT after determining that it was the most difficult option—and eventually earned her Ph.D. in the subject.

It was at MIT that Su first experienced a semiconductor lab, where she was taken by the idea that such a tiny piece of hardware could carry so much mathematical firepower. She spent the first years of her career at Texas Instruments and IBM, two first-wave tech titans, which taught her about how to run a business and manage teams. “I was really lucky early in my career,” she says. “Every two years, I did a different thing.” She accepted a VP job at AMD in 2012, and by 2014 had ascended to CEO. “I felt like I was in training for the opportunity to do something meaningful in the semiconductor industry,” she says. “And AMD was my shot.”

Su took over an indebted firm that had fired 25% of its staff, sold and leased back its Austin office, and spun off its expensive chip factories. It was a moment of change for the tech industry writ large. Smartphones and tablets were ascendant. Consumer PCs, AMD’s main market, were in decline. “It didn’t look at the time that Lisa was really set up for success,” says Stacy Rasgon, a chip-industry analyst. “She was handed a tough situation.” Su’s turnaround plan had three steps: build great products, focus on customer relationships, and simplify the business. Some AMD board members wanted to pivot toward making low-power processors for phones. Su rejected that approach. “We needed to bet on what we were good at,” she says.

What AMD was good at was building powerful processors. Su set a goal for her engineers: to build a new CPU chip that was 40% faster than the previous generation’s. And she started a team on an even more ambitious project: to explore how to develop a chip for the world’s first exascale supercomputer, a machine capable of carrying out 1 quintillion operations per second. The decisions revealed a core tenet of Su’s leadership philosophy. “People are really motivated by ambitious goals,” she says. “The previous strategy of, hey, let’s just do a little bit better here and there—that’s actually less motivational.”

The problem was that Su’s plans would take years to come to fruition. In the meantime, AMD was still on the ropes. “My job as a CEO was to give the engineers time to do the work,” Su says. She inked deals with console manufacturers that won AMD the revenue it needed to keep afloat. In 2016, she signed another with a consortium of Chinese companies, licensing some of AMD’s designs so they could make processors for the Chinese market. That deal brought in $293 million, though it would later come back to haunt AMD.

By 2017, the company was on stronger financial footing and the new flagship chip was finally ready. Engineers had redesigned the CPU from the ground up, making use of a new architecture, which the company called “chiplets.” Until then, the chip industry had mainly etched the different parts of a processor onto one piece of silicon. AMD’s innovation was to put different circuits onto individual pieces of silicon and then fuse them all together, which made manufacturing more reliable and scalable. Engineers suggested to Su that they call the new chip “Zen,” because it was designed with a balance in mind between energy efficiency and high performance. The name stuck.

Meanwhile, Intel, AMD’s main competitor, was beginning to flounder. Its new cloud processors were beset by delays. When AMD’s chips hit the market, they were the best on the block. With each new generation of Zen, AMD’s share of the cloud-CPU market grew. Today, its share of that market is 34%. When AMD’s overall valuation surpassed Intel’s in 2022, “it felt fantastic,” Norrod says. “It’s something that I don’t think anybody in the industry would have believed was possible just a few years ago.”

One recent afternoon at AMD’s Santa Clara headquarters, Su was sitting with several senior executives in the CEO’s favorite corner conference room, where the offices of both Nvidia and Intel are visible through the glass. In the meeting, Su pressed her colleagues to meet engineering milestones for the specialized chips that AMD sells for use in AI data centers. “We cannot miss a beat,” Su told them. “We have negative slack. Whatever we do organizationally, we cannot slow down.”

AMD is grappling with geopolitical challenges that could reshape the semiconductor industry. Today’s chips have billions of transistors, tiny gates for managing electric current. To manufacture them requires colossal machines with hundreds of thousands of specialized parts, which fire lasers at tiny droplets of molten tin to create extreme ultraviolet light that bounces through a series of multilayered mirrors and, ultimately, etches designs onto thin wafers of silicon with atomic-level accuracy. A stray particle in the machine, a half-degree fluctuation in temperature, or a nanometer-scale vibration could each threaten a batch of chips worth millions of dollars. The process is so complex, fragile, and expensive that only one company is currently able to manufacture at scale the most cutting-edge chips designed by the likes of AMD and Nvidia: Taiwan Semiconductor Manufacturing Co. The industry’s most advanced chips may be conceived in Silicon Valley, but their fabrication is almost entirely outsourced to just a handful of factories on the west coast of Taiwan.

Some 80 miles across the Taiwan Strait lies China, which claims the self-governing island as its territory. Chinese President Xi Jinping has instructed his military to be ready to invade Taiwan by 2027, according to U.S. intelligence assessments made public last year. And Xi has set China on a path to reduce its technological dependence on the U.S. by producing powerful chips of its own. Without Taiwanese manufacturing, the semiconductor industry would be upended and the world’s supply of advanced chips would plummet. And if Beijing’s effort to become a world-leading semiconductor producer is successful, it would set up China’s military and AI industry to match or outpace America’s, which many in Washington view as a national-security threat.

In this light, Su’s 2016 decision to go into business with Chinese state-backed companies looks like a misstep. Pentagon officials tried and failed to block the deal at the time, according to a report in the Wall Street Journal, which cited worries that AMD had transferred crucial know-how that could aid China’s military and domestic semiconductor ambitions. AMD denied suggestions that it had sought to evade regulatory scrutiny on the deal, saying that it had correctly briefed the Pentagon and other agencies and had received no objections, and that the Journal’s story contained “several factual errors and omissions.” At the time, there were few laws against technology transfer to China, and deeper economic integration between the two powers was viewed by many as natural. “It was a very different era,” Su says. But the music would quickly change. In 2019, the Trump Administration placed AMD’s Chinese joint venture on the “entity list” that restricts exports of critical technologies to foreign adversaries because of perceived security risks. In 2022, the Biden Administration passed broader export controls that made it illegal for companies like AMD and Nvidia to sell their most advanced chips to Chinese companies.

Demand for specialized AI chips is so high, and their supply so constrained, that these export controls have so far had little effect on chipmakers’ bottom lines. But Trump is expected to further expand tariffs and sanctions on China, which could quickly become painful for chip companies. Some 15% of AMD’s revenue in 2023—$3.4 billion—came from the legal sale of less powerful chips to China and Hong Kong. AMD warned investors in October that its business could be adversely affected by tariffs, as well as any retaliatory measures imposed by foreign governments. If it’s any consolation for AMD’s market position, its rivals are even more exposed: in 2023, China and Hong Kong accounted for 17% of Nvidia’s revenue, and China represented 27% of Intel’s. “We want to service the entire world with our chips,” Su says. “[But] I’m certainly a believer in: we want to be the most advanced semiconductor country.”

Still, AMD is incentivized to lobby against the widening of chip export controls, even if officials determine that more sanctions would be in the interests of national security. The Semiconductor Industry Association, a trade group of U.S. chip companies including AMD, argues against export controls, and has spent more than $4.5 million since 2022 lobbying lawmakers in Washington, according to the watchdog OpenSecrets. “You have to run faster,” Su says of her view of the U.S.’s competition with China. She says her main goal with any lobbying is to help lawmakers make sure “that any desired policy has the desired effect,” adding, “We certainly want to be a good corporate citizen.”

Inside a high-security laboratory beyond the dry hills at Silicon Valley’s eastern edge, a team of government scientists celebrated a major milestone in November. The machine under their care, housed in a room longer than a football field, had just achieved the official title of most powerful supercomputer in the world. If every single person on earth were to make one calculation per second, it would take them over 480 years to calculate what this supercomputer could in one minute. The machine is called El Capitan, after the massive granite rock formation in Yosemite National Park. At its heart are more than 44,000 AMD chips called accelerated processing units (APUs), which combine elements of CPUs and GPUs in the same chip. When Su heard the news that El Capitan had officially become the most powerful supercomputer in the world, she was ecstatic. “These are the days I live for,” she says. The achievement meant that the two most powerful supercomputers in the world are now powered by AMD chips.

For Su, the win was about more than just bragging rights. “I personally visited the labs several times,” she says. Fulfilling her pledge to create best-in-class technology became almost an obsession, just as delivering Zen chips on time to waiting customers had been years earlier. “She’s so, so customer-centric,” says Vamsi Boppana, AMD’s senior vice president for AI. “She absolutely wants to delight, and that has served the company so well.”

Su views supercomputing as the wellspring from which further AI profits will flow. The chips in El Capitan are “without a doubt, the most complex thing we’ve ever built,” she says. But they were not a single-purpose investment. The designs that AMD engineers used for El Capitan are already trickling down into the specialized AI chips supplied to clients like Meta and Microsoft. The most advanced AMD chip currently on sale in the AI market, called the Instinct MI300X, is the “first cousin” of the chips inside El Capitan, says Mark Papermaster, AMD’s chief technology officer. That’s thanks to their chiplet-based designs, which make it relatively simple to switch in and out different components. “There is so much synergy between traditional high-performance supercomputing and AI,” Su says.

AMD always had a business in building GPUs for gaming, but after the release of ChatGPT in 2022, the company quickly spun up a more powerful line aimed at the data-center market. And in the past year, AMD’s projected revenue from specialized AI chip sales has leaped from essentially $0 to $5 billion, which would account for roughly 5% of that market. (Nvidia maintains a hammerlock on most of the rest.) This line of chips is now a popular choice for what’s known in the industry as AI “inference,” or the running of an already-formed AI system.

For years, the easiest way to increase AI performance was by simply training bigger models on more GPU chips. But as some computer scientists report diminishing returns from that practice, companies are now turning to a different strategy: increasing the time AIs spend running instead—in the inference phase, rather than the training phase. That could be good news for AMD, whose inference chips are approaching parity with Nvidia’s in terms of not only speed but also energy efficiency, which matters even more when you’re running an AI over a longer period. “We do see inference as a growing piece of the market,” says Boppana.

AMD is still struggling to break into the training phase of the market. That’s largely because Nvidia controls the world’s leading software for optimizing GPUs for that purpose—and it only works with Nvidia chips. The huge number of developers who already use it gives Nvidia an ongoing advantage. AMD is building its own competing software, but it is “absolutely behind Nvidia’s,” says Moorhead, the former AMD executive. Su says AMD is catching up. That’s partly thanks to an informal alliance with tech companies, including Meta, that want to avoid handing Nvidia an outright monopoly. Meta is buying AMD chips, contributing to AMD’s code base, and using its software in its data centers. “It’s a very good symbiotic relationship,” says Moorhead. “Without AMD, Nvidia can double their prices.” Says Su: “Nobody wants to be locked into a proprietary ecosystem. Really our strategy is: let’s invest in an open ecosystem. And then may the best chip win.”

Yet in their bid to reduce their reliance on Nvidia, major AI companies have also begun to design some of their own chips in-house. That could threaten AMD in the long term. But Su doesn’t see it that way. “I actually see it as an opportunity,” she says. No company wants to replicate the $6 billion AMD pours into R&D annually, she argues. She sees instead a future where big tech companies continue to spend on AMD’s chips, while also relying on their own chips for certain workloads. “There’s no one-size-fits-all in computing,” she says. “The broader the ecosystem, the bigger the party.”

If Su is right, the size of the party is going to keep on growing. She predicts the specialized AI chip market alone will grow to be worth $500 billion by 2028—more than the size of the entire semiconductor industry a decade ago. To be the No. 2 company in that market would still make AMD a behemoth. Sure, AMD won’t be overtaking Nvidia anytime soon. But Su measures her plans in decades. “When you invest in a new area, it is a five- to 10-year arc to really build out all of the various pieces,” she says. “The thing about our business is, everything takes time.”

—With reporting by Leslie Dickstein and Simmone Shah